CURRENT STATUS OF REGIONAL AQUACULTURE IN AFRICA, CASE OF NIGERIA

By: Dr Mustapha ABA. Aquaculture Scientific Expert. Fish Nutrition. Rabat. Morocco.

Introduction

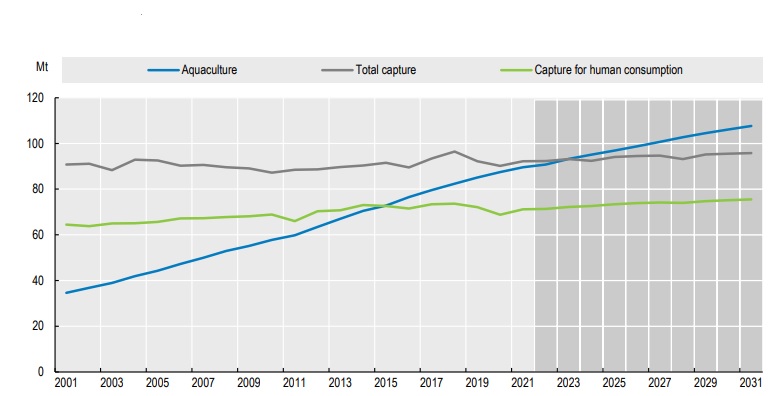

According to the OECD (2023), in order to ensure food security, world fish production should increase by 1.2% per year and should reach 203 Mt by 2031, an overall increase of 25 Mt (+14%) compared with the reference period (average 2019-2021), and by 2031, world aquaculture production should reach 108 Mt, 12 Mt more than the capture sector. Aquaculture will account for 53% of total fish supply in 2031, compared with 49% in the 2020 period (Figure 1).

Fig 1 : Aquaculture, total capture production and capture for human consumption (Source: OECD/FAO, 2022)

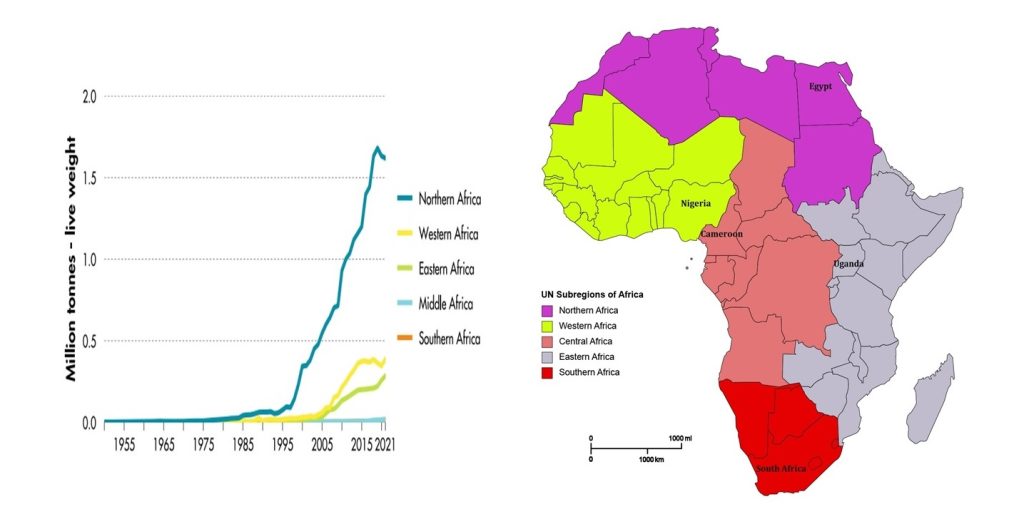

Fisheries catches have risen from 7 million tonnes to 10 million tonnes in 2020, while aquaculture production was around 450 000 tonnes in 2000, rising to almost 2 million 420 000 tonnes in 2020 (FAO, 2024).

The 2.4 million African aquaculture products are not evenly distributed across the continent, with African regions experiencing major disparities in aquaculture production for decades (Fig 2), with significant production since the 2000s in the North, West and East African regions, and of the 2.4 million tonnes produced in aquaculture on the African continent, North Africa produces almost 70% (almost all by Egypt), West Africa with 16.06%, while the East African region produces 15.70% of aquaculture products. Central and Southern Africa produce less than 1.3% (FAO, 2024).

Africa’s contribution to global aquaculture production is still insignificant (2%) (FAO, 2023), although it is increasing considerably with larger-scale investments in Egypt, Nigeria, Uganda and Ghana producing substantial quantities of fish (Cai et al., 2017). The region recorded a twenty-fold increase in production, rising from 1,110,200 to 2,418,844 tonnes from 1995 to 2021, with an annual growth rate of 15.55% (FAO 2023). The growth in aquaculture production shows huge disparities between the different regions of Africa, and the aim of this article is to analyse the current situation of aquaculture in the leading aquaculture producers in the 5 regions of Africa, namely Egypt in the North African region, Nigeria in the West African region, Uganda in the East African region, Cameroon in the Central African region and South Africa in the South African region.

Fig 2 : Aquaculture production in the 5 regions of Africa

CURRENT STATUS OF AQUACULTURE IN NIGERIA

Introduction

Nigeria is located in the West African region, the most populous country in Africa, and is a coastal country covering 0.69% of the world’s land area, representing 0.28% of the world’s inland water area and 0.11% of the world’s coastline, with 853 km of coastline (Ogunji and Wuertz, 2023). Although Nigeria is one of the world’s largest oil producers, agriculture remains the foundation of the economy, providing the main source of livelihood for most Nigerians (FAO 2016). Fisheries and aquaculture account for 3 to 4 per cent of Nigeria’s annual GDP, and these two sectors are also a key contributor to meeting the nutritional needs of the population, accounting for about 50 per cent of the animal-based food supply, and it is an important source of essential dietary nutrients (Oladimeji, 2017). Over the years, the issue of adequate food security has remained a crucial topic for government authorities in Nigeria (Osabohien et al., 2020). In Africa, fish is one of the main sources of animal protein, and although there is recognition of the need for increased production of farmed fish to compensate for the decline in capture fisheries (Oboh, 2022). Nigeria represents an attractive and growing market for aquaculture. It is supported by several macroeconomic market forces, such as attractive demographics as its population is expected to more than double by 2050 to 402 million, in addition to growing demand for dietary protein (Simus et al., 2022).

Fish production in Nigeria

Fish accounts for almost 40% of Nigeria’s protein intake, with fish consumption fluctuating between 11.2 and 13.3 kg/person/year (Ajayi et al., 2022; Adeleke et al., 2020). In fact, Nigeria stands out in Africa as the largest consumer of fish and also ranks among the largest consumers of fish in the world (Adelesi and Baruwa, 2022), this increase in demand for fish is attributed mainly to population growth and changing dietary preferences (FAO, 2022), but also by and preference for fish among consumers (Subasinghe et al., 2021).

According to the FAO (2022), Nigeria’s fisheries catch in 2000 was estimated at 44,137,77 tonnes, whereas in 2020 the catch will be 783,102 tonnes, with an annual growth rate of 2.91%. Aquaculture production in Nigeria rose from 25,718 tonnes in 2000 to 261,711 tonnes in 2020 (see Fig. 2).

Fig 1 : Status and trend of aquaculture production and fisheries in Nigeria (1950 2020). (FAO, 2022)

With an estimated population of 228 million, it is the seventh most populous country in the world, accounting for 15% of Africa’s population (Worldometer, 2024). Thanks to market-led development, aquaculture production in Nigeria has risen from 20,458 tonnes in 1998 to 291,233 tonnes in 2018 (Figure 1).

Aquaculture production in Nigeria

Currently, aquaculture has become one of the fastest growing agricultural enterprises, making Nigeria the second largest aquaculture producer in Africa and the largest aquaculture producing country in sub-Saharan Africa (FAO, 2023). Aquaculture plays a key role in the Nigerian economy, as in the economies of other African countries, in terms of job creation and income generation (Mulokozi et al., 2020, Nwuba et al., 2022). Nigeria is the second largest aquaculture producer in Africa and the success of Nigerian aquaculture is based on the production of African catfish, and Nigeria is currently the largest producer of African catfish in the world.

According to the FAO (2023), Nigeria’s fish production reached more than 1.08 million tonnes, divided between fishing (805,210 tonnes in 2021) and aquaculture (275,645 tonnes) (fishing 75%, aquaculture 25%). A deficit of around 2.5 million tonnes has to be made up by imports (Ogunji and Wuertz, 2023), and household fish consumption in Nigeria was only 13, 3 kg/capita/year, which is below the world average of 20.3 kg/capita/year (FAO, 2018), this shows that Nigeria is far from self-sufficient, as about 3.6 million tonnes of fish are consumed annually in Nigeria which imports 2.5 million metric tonnes of fish per year, making it one of the major fish importers in the developing world (Umakhihe, 2021).

Fig 2 : Aquaculture and fisheries Production in 2021 in Nigeria (FAO,2023)

Nigeria also leads the world in the production of African catfish (Clarias gariepinus) and African bonytongue (Heterotis niloticus). Unfortunately, Nigeria is far from self-sufficient in its fish supplies, with a deficit of around 2.5 million tonnes imported (Ogunji and Wuertz, 2023).

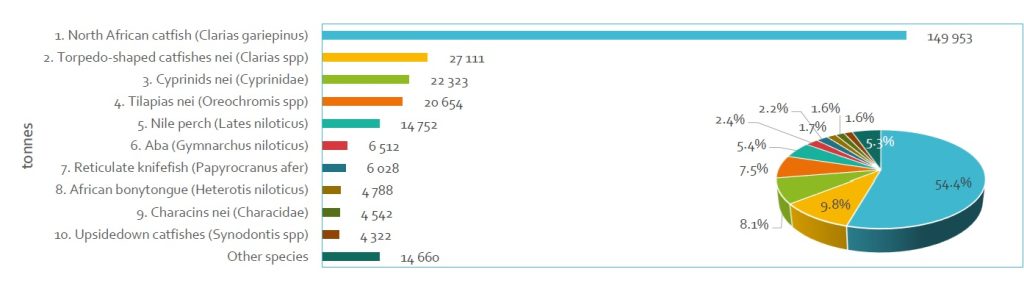

Aquaculture species in Nigeria

The success recorded in aquaculture in Nigeria is based on the production of African catfish, however, it has been shown that a high level of production and resilience in the aquaculture sector is positively correlated with the culture of several species. (Oboh, 2022), with production reaching 149,953 tonnes in 2023 (Fig4) (FAO, 2023) for catfish, with a rate of 54.4%, torpedo catfish with a production of 27,11 tonnes (9.8%), cyprinids with 22,323 tonnes (8.1%), tilapia with 20,654 tonnes (7.5%) and Nile perch with 14,752 tonnes (5.4%).

Fig 3: The 10 most cultivated fish species in Nigeria (FAO, 2023).

Conclusion

Overall, there is optimism about the future of aquaculture in Nigeria, especially as scientific aquaculture research in the country will remain key players in driving its progress. The development of aquaculture in Nigeria has become necessary to meet market demand and reduce dependence on imports in Africa’s most populous country, and the success of catfish aquaculture in Nigeria can serve as an example for the development of aquaculture of other species, while pointing to the importance of diversifying aquaculture species to meet the expectations of Nigerian consumers. The governance of aquaculture should be strengthened and become one of the mechanisms to ensure sustainable development of aquaculture in Nigeria to enhance food security and job creation.

Source : Magazine Aquaculture Feed Africa. Issue 2, Volume 1. 2024.

Source Photo :Fish Farming and Processing Business Plan in Nigeria